Your $350 Grocery Question: Gouging or Economics?

Dr. Sylvain Charlebois, a visiting scholar at McGill University and perhaps better known as the Food Professor, has lamented a strange and growing trend among Canadians. It seems that large numbers of especially younger people would prefer a world where grocery chains and food producers operated as non-profits and, ideally, were owned by governments.

Sure, some of them have probably heard stories about the empty shelves and rationing in Soviet-era food stores. But that’s just because “real” communism has never been tried.

In a slightly different context, University of Toronto Professor Joseph Heath recently responded to an adjacent (and popular) belief that there’s no reason we can’t grow all our food in publicly-owned farms right on our city streets and parks:

“Unfortunately, they do have answers, and anyone who stops to think for a minute will know what they are. It’s not difficult to calculate the amount of agricultural land that is required to support the population of a large urban area (such as Tokyo, where Saitō lives). All of the farms in Japan combined produce only enough food to sustain 38% of the Japanese population. This is all so obvious that it feels stupid even to be pointing it out.”

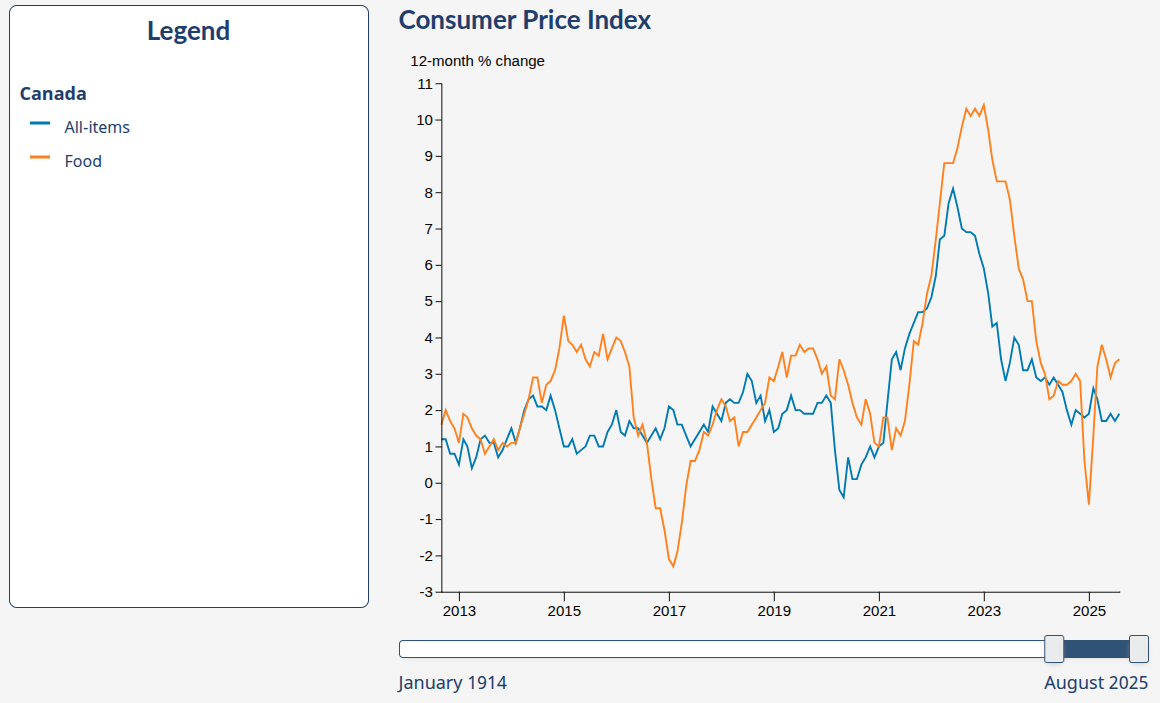

Sure, food prices have been rising. Here’s a screenshot from Statistics Canada’s Consumer Price Index price trends page. As you can see, the 12-month percentage change of the food component of the CPI is currently at 3.4 percent. That’s kind of inseparable from inflation.

But it’s just possible that there’s more going on here than greedy corporate price gouging.

It should be obvious that grocery retailers are subject to volatile supply chain costs. According to Statistics Canada, as of June 2025, for example, the price of “livestock and animal products” had increased by 130 percent over their 2007 prices. And “crops” saw a 67 percent increase over that same period. Grocers also have to lay out for higher packaging material costs that include an extra 35 percent (since 2021) for “foam products for packaging” and 78 percent more for “paperboard containers”.

In the years since 2012, farmers themselves had to deal with 49 percent growth in “commercial seed and plant” prices, 46 percent increases in the cost of production insurance, and a near-tripling of the cost of live cattle.

So should we conclude that Big Grocery is basically an industry whose profits are held to a barely sustainable minimum by macro economic events far beyond their control? Well that’s pretty much what the Retail Council of Canada (RCC) claims. Back in 2023, Competition Bureau Canada published a lengthy response from the RCC to the consultation on the Market study of retail grocery.

The piece made a compelling argument that food sales deliver razor-thin profit margins which are balanced by the sale of more lucrative non-food products like cosmetics.

However, things may not be quite as simple as the RCC presents them. For instance:

While it’s true that the large number of supermarket chains in Canada suggests there’s little concentration in the sector, the fact is that most independents buy their stock as wholesale from the largest companies.

The report pointed to Costco and Walmart as proof that new competitors can easily enter the market, but those decades-old well-financed expansions prove little about the way the modern market works. And online grocery shopping in Canada is still far from established.

Consolidated reporting methods would make it hard to substantiate some of the report’s claims of ultra-thin profit margins on food.

The fact that grocers are passing on costs selectively through promotional strategies, private-label pricing, and shrinkflation adjustments suggests that they retain at least some control over their supplier costs.

The claim that Canada’s food price inflation is more or less the same as in other peer countries was true in 2022. But we’ve since seen higher inflation here than, for instance, in the U.S.

Nevertheless, there’s vanishingly little evidence to support claims of outright price gouging. Rising supply chain costs are real and even high-end estimates of Loblaw, Metro, and Sobeys net profit margins are in the two to five percent range. That’s hardly robber baron territory.

What probably is happening is some opportunistic margin-taking through various selective pricing strategies. And at least some price collusion has been confirmed.

How much might such measures have cost the average Canadian family? A reasonable estimate places the figure at between $150 and $350 a year. That’s real money, but it’s hardly enough to justify gutting the entire free market in favor of some suicidal system of central planning and control.

You might enjoy some related reading:

Does Immigration Drive Up Canadian Housing Prices?

The Free Press recently published a fascinating article claiming that immigration is not a significant cause of housing cost increases in the U.S. I’m not sure I’m completely convinced by their arguments, but the piece immediately got me wondering about Canada. Is there a meaningful relationship between the massive waves of immigration we’ve experienced…

As a paperboy in the early to mid sixties, I actually read what I delivered and remember coming across an interesting tidbit about Soviet agricultural production - that 40% of foodstuffs came from the 3% of agricultural land "necessarily" allowed as private plots. This didn't bode well for the central planning, bureaucratic weight, and total lack of individual incentives in the collective farms managed on the other 97% of Agricultural land. I might be missing another example but the only collective success in agriculture that comes to mind is on the Hutterite colonies where the glue that holds it all together is a decentralized and strictly religious one rather than the dead hand of the state.

A man walks into a butcher shop in Soviet Russia and asks, “How much is a chicken?”

The shop owner says, “a chicken is 15 Rubles.”

The man exclaims, “That’s terrible, Comrade! Down the street a chicken is only 10 Rubles!”

The butcher asks, “Why don’t you buy your chicken from down the street then?”

The man replies, “I would, but they’re out of chicken.”

To which the butcher says, “well, when we’re out of chicken, the price is only 7 Rubles.

...

Soviet Amnesia: a man standing in the middle of the street holding an empty bag not sure whether he's about to go shopping or has already been.