Do Electric Vehicle Subsidies Work?

Plus: the results of our recent immigration policy survey

Governments in Canada have been begging us to purchase EVs and plug-in hybrids for years. The carrot has been $600 million annually in federal subsidies (and more at the provincial level) aimed at consumers. The stick is the dark threat of outlawing internal combustion engines altogether. A third approach involves splashing billions of dollars of handouts and tax credits in the general direction of companies with starry-eyed plans to manufacture EV components locally.

I’m not going to discuss whether EVs are actually the best solution for whatever ails the environment. That may be a few levels above my pay grade. Instead, I’d like to analyze whether the consumer-focused subsidies actually worked.

To do that I first identified the provinces that offered subsidies for “battery electric vehicles” (i.e., EVs). Those would be British Columbia, Quebec, New Brunswick, Prince Edward Island, Nova Scotia, and Newfoundland. That’ll give us a nice reference point for comparison against provinces that don’t offer subsidies. Specifically, those are Alberta, Saskatchewan, Manitoba, and Ontario. (Although Manitoba did just introduce a rebate program in July of 2024.)

Of course, there are also federal subsidies available across the country.

Now there is one problem with the Statistics Canada sales data. Due to some weird licensing issue, there’s no sales data at all for Newfoundland, Nova Scotia, or Alberta. We’ll just have to do our best with what we’ve got.

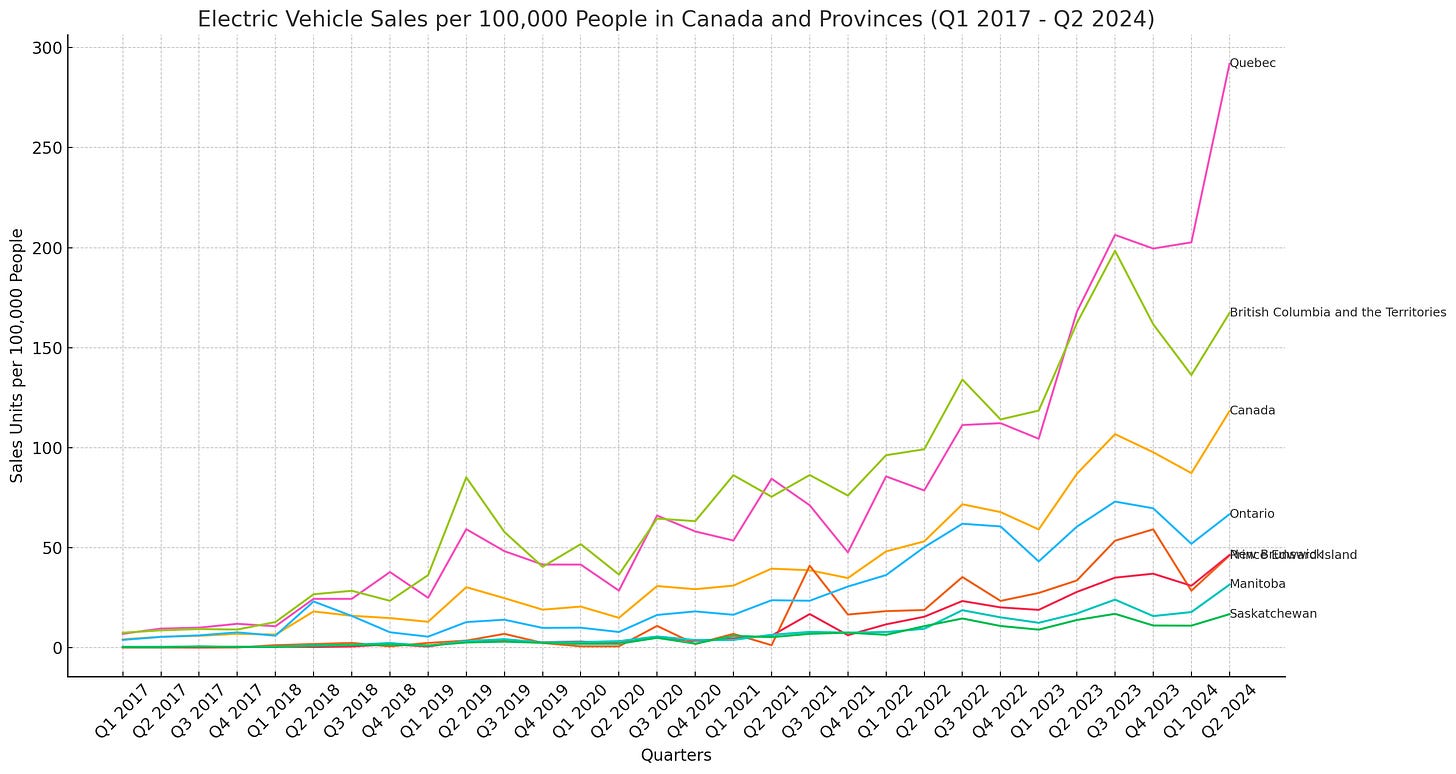

Here are the numbers expressed as sales per 100,000 people (based on 2024 provincial population estimates):

The obvious big mover here is Quebec. Their Roulez Vert program - at $7,000 - is the most generous in the country (although it’s currently set to be phased-out by 2027). But Roulez Vert has been around since 2012, so it might not completely explain those huge jumps since 2022.

If you squint really hard at the graph, you should notice a modest jump in Ontario EV sales back in 2018. That would probably be due to last-minute bargain hunters reacting to the Ford government’s plans to cancel Ontario’s rebate.

But none of that is going to give us the precision we need to answer our real question: did government subsidies actually drive more EV sales? For that, we’ll need a bit of statistical analysis. This scatter plot visualizes the relationships between subsidies and average sales over time:

If our only data point was Quebec - with its impressive sales and high subsidy level - then the conclusion would be straightforward. But that’s exactly why we look for more data. So, for instance, BC has sales that, proportionally, were close to Quebec’s but with rebates that were 40 percent lower. And Canada’s federal rebates played a role in relatively few overall sales.

For those of you who enjoy such things, here are the actual numbers SciPy’s linear regression gave me:

Slope: 0.005910745672259122 Intercept: 13.256019105900187 R-squared: 0.31881294222441453 P-value: 0.14480378835260208 Standard Error: 0.00352721449117312

The slope indicates that for every additional thousand dollars of subsidy, EV sales would increase by only around six vehicles per 100,000 people. That’s compared with the intercept (13.26) which estimates the baseline (no-subsidy) sales at 13.26 units per 100,000 people.